Automated Data/Statistical/Stock Analysis/Sports Betting

- Status: Closed

- Premie: $490

- Mottatte bidrag: 17

- Vinner: vivekgarg96

Konkurransesammendrag

UPDATED BRIEF:

Folks, thank you for the responses so far. I have something very specific in mind and I used the stock analogy to help explain my scenario. I want to be able to enter a range of values into an Excel sheet as provided originally.

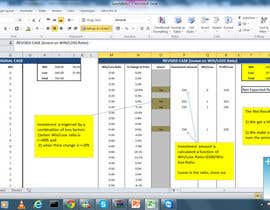

The values actually relate to sports odds and I want the ability to easily perform data manipulation. Some of these requirements would be to delete all rows where the values fall outside a specific range (e.g. between 2.50 to 3.00) and have the remaining rows plotted on a graph with the usual support and resistance lines, moving averages, etc.

I already know the statistical percentage of winning bets but want this to be configurable. So if I said that 50% of bets are successful you could further improve my chances of winning by devising some further indicators on the graph to tell me when to place a bet. Please take the bet price into consideration if you feel that this should be used to determine a variable staking plan.

Please see latest sample attached which shows those bets that were successful (column A) and the relevant odds which were between 1.8 and 2.2 (column B). There are 761 bets with 368 of them winning. That's an average strike rate of 48% with an average price of 2.00.

It's unlikely that anyone will be able to produce exactly what I'm looking for but I'll probably engage with somebody based on the responses received and provide more details and take it from there until we get close to what I'm looking for.

ORIGINAL BRIEF:

Taking the attached master spreadsheet can you plot a graph based on the running share price in column A. This includes the daily closing trading price of a specific stock from Monday to Friday for one complete year.

Please apply some support and resistance lines to the graph to see where would be most beneficial regarding trading the stock (i.e. where to buy and sell)?

Using your statistical expertise can you also recommend other methods of profiting from this trading range? For example, what win loss ratios and stop losses, etc. would best suit. Please also include any other analysis/formulas/scenarios that would help identify a profitable return.

Ideally, I would like to have your thought analysis saved as a blueprint so that I can take it and apply it to any scenario. I understand that each scenario is different but if you can devise something that would be worth applying to the majority of situations. In other words, I want some formula/macro/program that can be run against a spreadsheet that will plot support and resistance lines against a running stock price and provide best fit win/loss ratios, etc.

I also want the ability to remove certain periods from the master spreadsheet. For example if I decided to remove every 5th row from the spreadsheet, the support/resistance lines would recalculate based on the new data. I say every 5th row so that data for one day of the week (i.e. Friday in this instance) is excluded. It might be best to use two further worksheets to show the separation of data (i.e. one showing all Friday data and one showing all Monday to Thursday data). The idea behind this is that I’d like see if I could profit from trading based on one day only so the newly created formulas/macros/programs could be applied to a smaller set of data.

Taking it another step, if I was looking to trade on a Friday, could you combine the original master graph and the new Friday graph to signal stronger buy/sell indicators?

To go one final step, I want to extract a collection of rows and graph them separately like we did with the Friday data. The rows and the amount of them would be random so I would want the ability to remove, for example, rows 11, 56, 174, 375, 5752, and 6855. This idea behind this is that I want to plot a graph of the stock price every time there is a news announcement.

I would also like this graph to be combined with the master graph to help identify stronger buy/sell signals.

Anbefalte ferdigheter

Offentlig avklaringstavle

Hvordan å komme i gang med konkurranser

-

Legg ut din konkurranse Raskt og enkelt

-

Få mange bidrag Fra hele verden

-

Kår det beste bidraget Last ned filene - Enkelt!